How Much Does It Cost To Register An Llc In Michigan

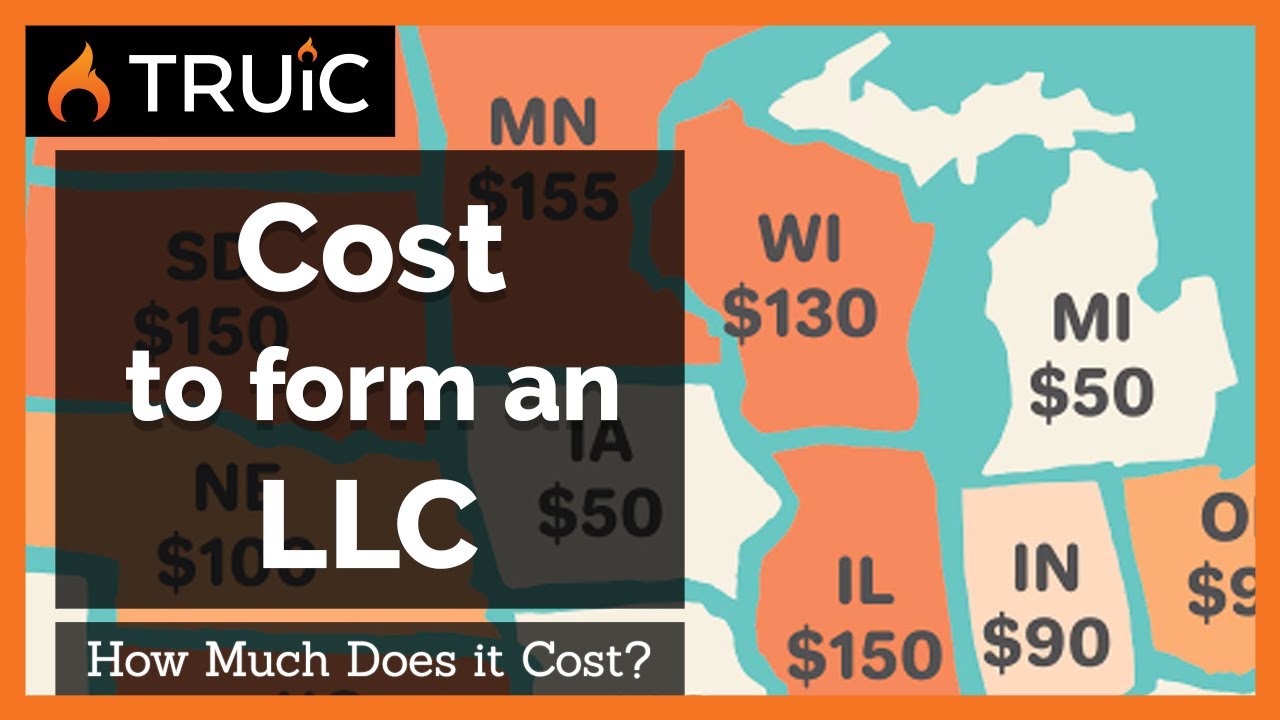

Llc filing fees range from 40 to 500.

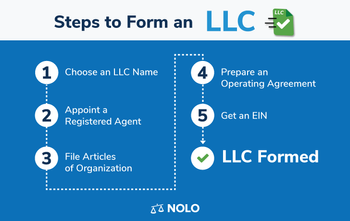

How much does it cost to register an llc in michigan. The articles of organization is the legal document that officially creates your michigan limited liability company. To start an llc in michigan you must file articles of organization with the michigan corporations division. There are several different price options to consider when renewing your llc in michigan including. Once filed with the state this document formally creates your michigan llc. If the llc s income exceeds 250 000 it will owe an additional llc tax based on the income amount.

You can apply online in person or by mail. Some fees mentioned in the video above have changed. As of late 2020 the average llc annual fee in the us is 91. Starting an llc in michigan is easy to start an llc in michigan you will need to file your articles of organization with the state of michigan which costs 50. You can file the document online or by mail.

A 20 reporting fee is required to file statement of information 90 days after formation and then every two years. The articles of organization cost 50 to file. Further an annual 800 llc tax is due by the 15th day of the fourth month after llc formation and every year thereafter. Some fees mentioned in the video above have changed. 10 for the renewal certificate 25 per annual report filing fee up to 50 per year annual penalty for late filing.

The table below shows llc annual fees by state. The michigan limited liability company act sets out particular activities which in and of themselves do not constitute transacting business. Make sure to reference the table below for the most accurate information.