How To Register Business For Jobkeeper

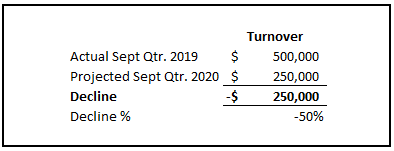

From 4 january 2021 to 28 march 2021 the new decline in turnover form to work out eligibility for the second extension period will be available.

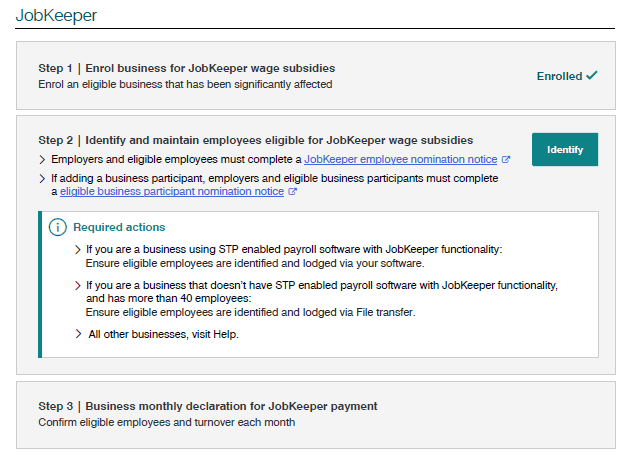

How to register business for jobkeeper. Employers or their accountants need to log into the business portal on the ato s website using their mygovid where they can access jobkeeper enrollment forms. Existing eligible employers must submit the new decline in turnover form before completing their business monthly declarations from 1 february. The government s 130 billion jobkeeper scheme is the biggest financial lifeline australia has ever seen. The federal government is moving to provide subsidies to australian businesses to keep the nation s workers employed. The jobkeeper payment will be available to eligible businesses including the self employed and not for profits until 28 march 2021.

The jobkeeper payment is administered by the australian taxation office ato. Whilst we believe the information provided is all that you need to manage your participation in the jobkeeper scheme we are able to assist with determining eligibility registering applying and reporting on your behalf. You ll need to provide each employee with a jobkeeper employee nomination notice form that they ll need to complete and return to you or your registered tax or bas agent as soon as possible. Eligible business participant jobkeeper i m also trying to add a director for jobkeeper. You must do this by the end of april to claim jobkeeper payments for april.

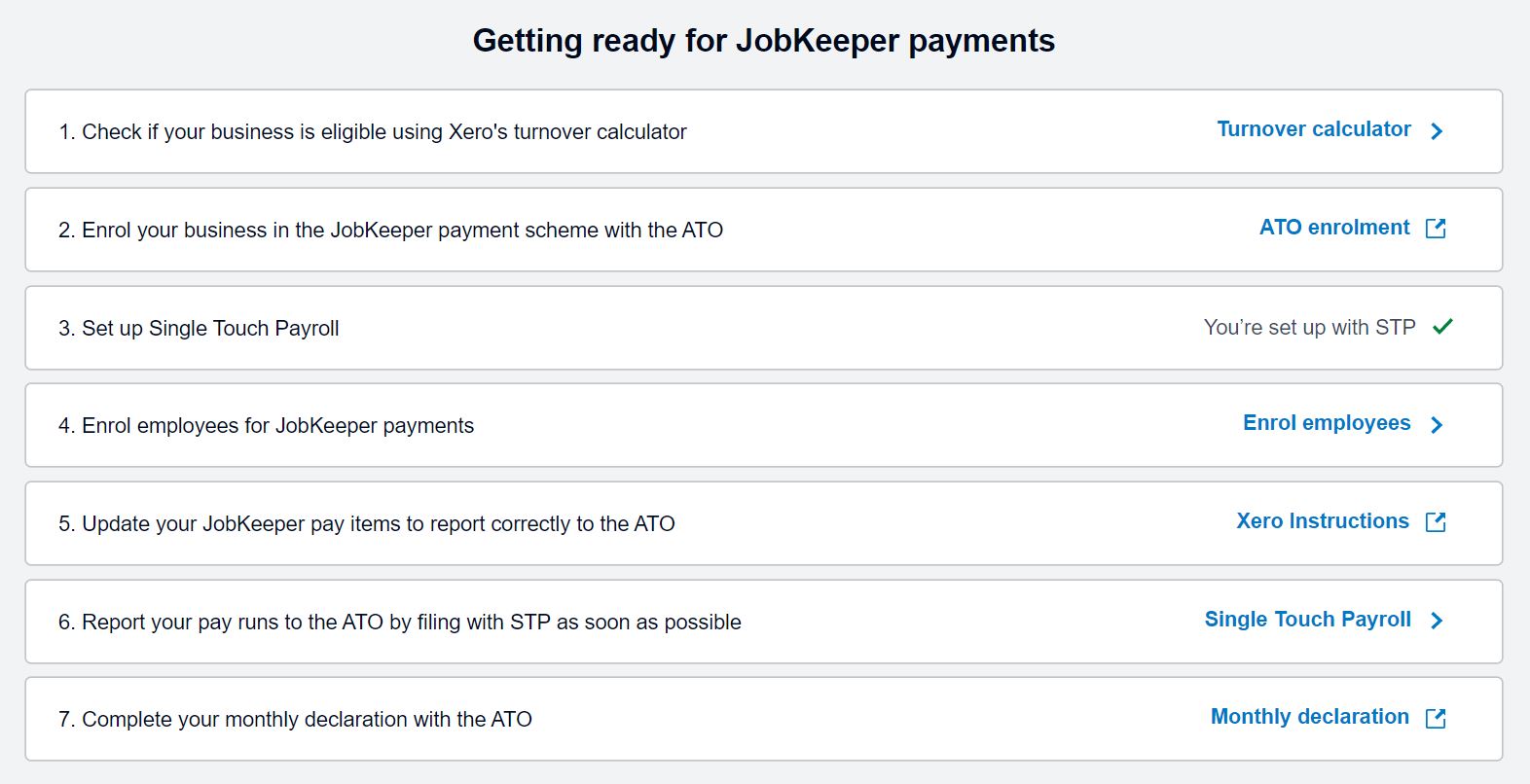

You can register for jobkeeper on or after 20 april 2020. The jobkeeper payment scheme has been extended until 28 march 2021 see jobkeeper extension. The following is a step by step action plan for any eligible business wishing to participate in the jobkeeper program. The jobkeeper payment is critical to the survival of small businesses that have been impacted by the covid 19 crisis. How to register for jobkeeper monday march 30 2020.

Applications will remain open until the end of may but businesses are being advised to apply before the end of april to receive payments as quickly as possible. The two parts to registering are. The jobkeeper payment is a scheme to support businesses and not for profit organisations significantly affected by covid 19 to help keep more australians in jobs. You must pay each of your eligible employees at least 1 500 per fortnight while your business is participating in the jobkeeper payment scheme. When you register with ato it allows you to tick a box to say you want to claim for one director but it has no further information on how to go about it.

Setup in your payroll the allowances jobkeeper topup and jobkeeper start fn01 codes and pay all your eligible employees 0 01 in the start allowance to tell the ato this is the first jobkeeper fortnight that your employee is eligible for the subsidy.