How To Register For Unemployment Tax In Florida

Then complete the enrollment section using your business s information i e.

How to register for unemployment tax in florida. Taxpayer education seminars the florida department of revenue provides free taxpayer education seminars that will help you understand your tax responsibilities how to comply with the florida tax laws and the application of florida tax laws affecting various businesses. Blank forms are available for download from the forms and publications section of the dor website. The paper form contains sections to register your business for a variety of state taxes. New users must create a user profile with a username and password to begin or complete the registration application. Tax sales and use learn what is taxable how to register to collect tax and how tax is calculated.

There is no fee to register your business for reemployment tax purposes. Employers must file quarterly earnings reports and accurate copies of form rt 6 at the end of the month following the end of each fiscal quarter. For returning users enter your user profile credentials to log in and begin or complete the florida business tax registration application. Then after 3 business days call the fl dor at 850 488 6800 to obtain the account number and rate information. To register online use the dor s online registration website.

To register on paper use form dr 1 florida business tax application. You can also register by completing and submitting a paper florida business tax application form dr 1. The department recommends that employers register to pay reemployment tax using the online florida business tax application or complete and submit a paper florida business tax application form dr 1. If you have other taxes you ll be filing for your business like sales tax mark yes. A florida unemployment insurance tax registration can only be obtained through an authorized government agency.

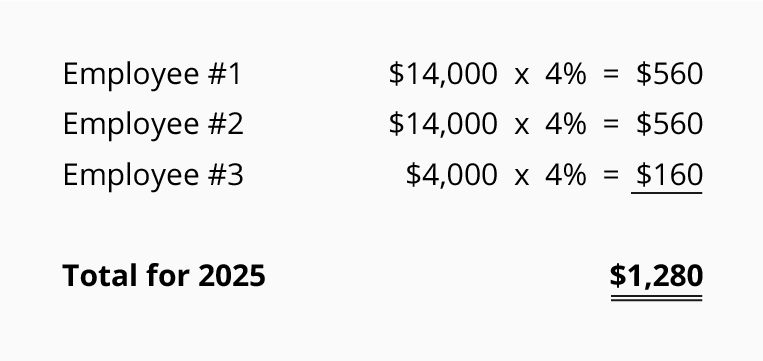

Register with the florida department of revenue click here to register your business and select create user profile. If you do not have a username and password select the create user profile button below. Depending on the type of business where you re doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a florida unemployment insurance tax registration. The due dates are. Companies who pay employees in florida must register with the florida department of revenue for a reemployment tax account number.

Your company s contact info your company s banking information etc. Gusto will complete your electronic enrollment for unemployment tax known as re employment tax in florida. To establish your florida ui tax account you ll need a federal employer identification. You are not required to register with the florida department of revenue until you have quarterly payroll of 1500 or more in a calendar year or one or more employees for a day during any 20 weeks in a calendar year.