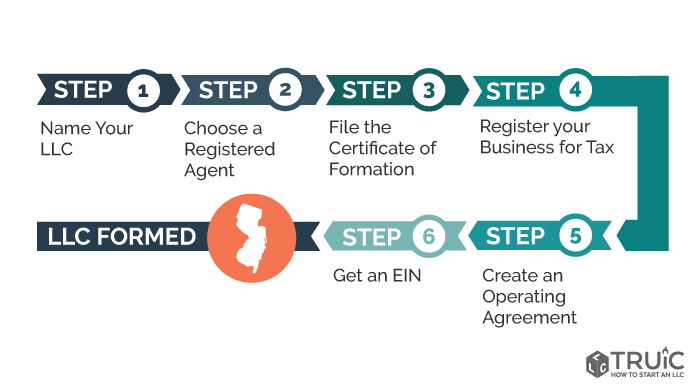

How To Register Your Llc In Nj

The certificate of formation for an llc limited liability company in new jersey is a legal document to officially form your business.

How to register your llc in nj. If you already formed an llc in another state but want to do business in new jersey you must first register with the new jersey division of revenue and appoint a registered agent for service of process. All submissions must be accompanied by a 125 filing fee. You can apply online by mail or in person. Method of filing. To form an llc a registrant must first file a public records filing with the new jersey department of treasury division of revenue.

To register your new jersey llc you will need to file the certificate of formation with the new jersey division of revenue. You can both form and register your new jersey llc by mail or online however we recommend the online filing. This entails filing a form and paying an annual fee which varies from state to state. You are looking to start a sole proprietorship or partnership. Typical turnaround time for the filing to be finalized is 2 3 weeks.

Hiring the right people is one of the most important things you can do for your business. Be sure to take advantage of local resources to help you on your way while also making sure that. Once you finish each section it will be marked with a check mark. This form works for all business structures in new jersey. The filing fee is 125.

An llc with more than one member is also strongly advised to have a limited liability operating agreement among its members. Keep old llc and register in new state perhaps the easiest way to move your llc to a new state is to keep your old llc and register it as a foreign llc in the new state where you want to relocate. A limited liability company is registered in new jersey by submitting a public records filing for new business entity with the filing fee to the new jersey division of revenue corporate filing unit. All companies doing business in new jersey need to register with the state. Register for new jersey tax employer purposes.

All businesses operating in new jersey must file form nj reg either by applying online or filing by paper. The first step to forming an llc in new jersey is completing and filing a public records filing for a new business entity and the 125 filing fee with the new jersey division of revenue in the department of treasury. To register as a foreign llc you file the same form as a new business entity and pay the 125 filing fee. Submit the form by mail fax in person or online. Please use the navigation to the left to complete your business filing.