How To Register A Foreign Llc In New York State

Companies register with the new york state department of state nysdos.

How to register a foreign llc in new york state. Businesses should consult with an attorney to learn more about legal structures. To obtain this consent call the new york state tax department call center at 518 485 2639. Determine if a name i want to use is available. For example a limited liability company llc isn t allowed to have words like school trust or corporation and dozens of others in its name. See a complete list of restricted words here.

Use a credit card debit card to pay a fee. Apart from filing the application with the sos you also must publish the information contained in the application once in each week for six successive weeks in two newspapers of the new york county where the office of the foreign limited liability company is located. If you already have an llc you are set for that state. To qualify to do business in new york foreign corporations pcs llcs pllcs and lps must file an application for authority and foreign rllps must file a notice of registration with the dos. Form a limited liability company.

Do business under an assumed name dba fax a request to the division of corporations. Obtain copies of documents. Foreign corporations that have never done business in new york state must give dos. Obtain a certificate of status. The application for authority costs 250 to file.

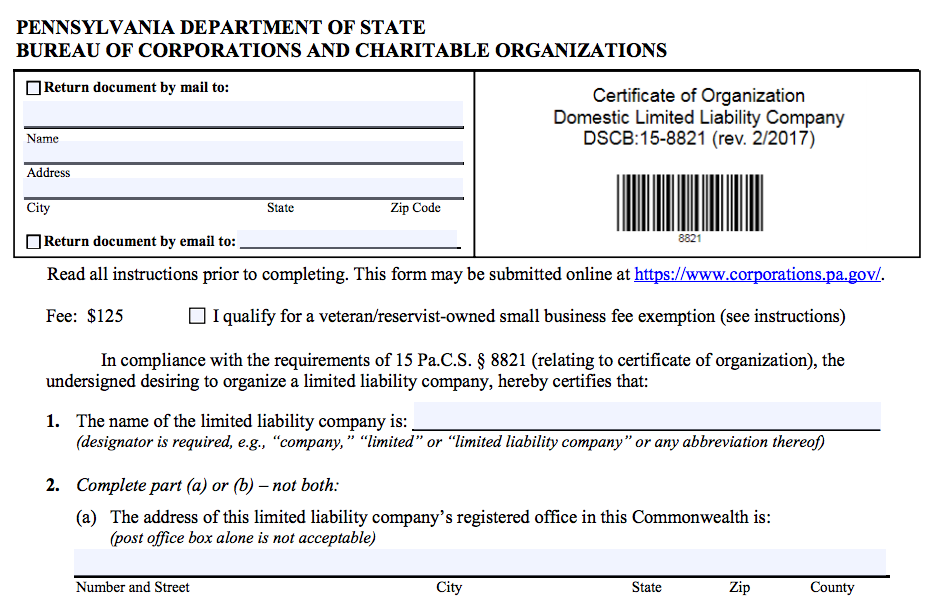

After settling your name and type of entity it s time to register your business with local and state agencies. Next determine if you are doing business in another state and are thus required to register as a foreign llc in that state. An out of state limited liability company can register for a certificate of authority in new york state. If your company is registered outside of new york it is required to obtain a certificate of authority before transacting business in the state. This process is called foreign qualification and it involves filing application for authority form with the new york state department of state.

A 225 filing fee. Foreign corporations currently or previously doing business in new york state must obtain the tax commissioner s consent that all tax returns due are filed and all taxes due are paid before applying for authority. Registering your company as foreign entity in new york. File as a foreign corporation. Form a not for profit corporation.